-

Legal Project Management teaches you to identify waste as a result of the weak interaction between the system, process and people, and to resolve it.

Legal Project Management teaches you to identify waste as a result of the weak interaction between the system, process and people, and to resolve it. -

One of the key findings in this year’s LexisNexis SA and the Law Society of South Africa’s (LSSA’s) Legal Tech survey into the legal profession, shows a small increase in black legal professionals, while a lack of BEE credentials is a worry for smaller legal firms.

One of the key findings in this year’s LexisNexis SA and the Law Society of South Africa’s (LSSA’s) Legal Tech survey into the legal profession, shows a small increase in black legal professionals, while a lack of BEE credentials is a worry for smaller legal firms. -

In this third of a six-part series showcasing champions of the rule of law in Africa, Karim Anjarwalla, Managing Partner of ALN Kenya | Anjarwalla & Khanna (A&K), talks to Craig Sisterson about the unsung heroes in everyday life who uphold and strengthen the rule of law.

In this third of a six-part series showcasing champions of the rule of law in Africa, Karim Anjarwalla, Managing Partner of ALN Kenya | Anjarwalla & Khanna (A&K), talks to Craig Sisterson about the unsung heroes in everyday life who uphold and strengthen the rule of law. -

In Moos v Makgoba [2022] JOL 54225 (GP), evidence necessary of psychological, economic, or mental harm to secure a protection order.

In Moos v Makgoba [2022] JOL 54225 (GP), evidence necessary of psychological, economic, or mental harm to secure a protection order. -

In the third of a six-part series showcasing champions of the rule of law in Africa, Karim Anjarwalla of ALN talks to Craig Sisterson.

In the third of a six-part series showcasing champions of the rule of law in Africa, Karim Anjarwalla of ALN talks to Craig Sisterson. -

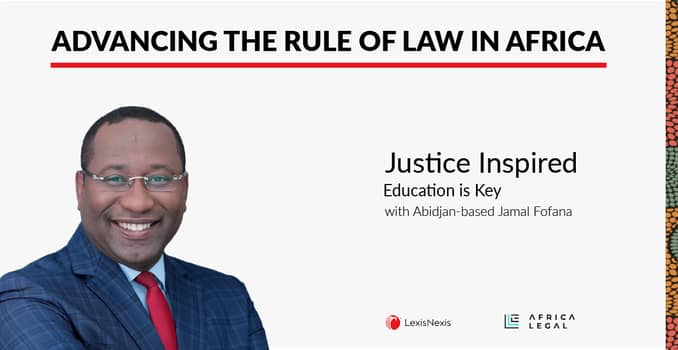

In the first of a six-part series, Abidjan-based Jamal Fofana of Asafo & Co. in Côte d'Ivoire talks to Craig Sisterson about educating people on the rule of law concept and thus making an impact on society.

In the first of a six-part series, Abidjan-based Jamal Fofana of Asafo & Co. in Côte d'Ivoire talks to Craig Sisterson about educating people on the rule of law concept and thus making an impact on society. -

In the fourth of a six-part series showcasing champions of the rule of law in Africa, Khrushchev Ekwueme of Olaniwun Ajayi LP talks to Craig Sisterson about lawyers’ roles in supporting the court system.

In the fourth of a six-part series showcasing champions of the rule of law in Africa, Khrushchev Ekwueme of Olaniwun Ajayi LP talks to Craig Sisterson about lawyers’ roles in supporting the court system. -

Value-based pricing is the new kid on the block for many law firms. Despite being the model which shows the highest level of client retention, few law firms are using it.

Value-based pricing is the new kid on the block for many law firms. Despite being the model which shows the highest level of client retention, few law firms are using it. -

In the first of a six-part series showcasing champions of the rule of law in Africa, Jamal Fofana of Asafo & Co. in Côte d'Ivoire talks to Craig Sisterson about educating people on the rule of law concept and thus making an impact on society.

In the first of a six-part series showcasing champions of the rule of law in Africa, Jamal Fofana of Asafo & Co. in Côte d'Ivoire talks to Craig Sisterson about educating people on the rule of law concept and thus making an impact on society. -

In Davids v S [2022] 4 All SA 67 (WCC) where a court building is situated does not compromise the institutional and individual independence of the court and/or the judge.

In Davids v S [2022] 4 All SA 67 (WCC) where a court building is situated does not compromise the institutional and individual independence of the court and/or the judge.

Lexis Nexis

Lexis Nexis