Legal Blog

Find all the latest legal articles, practical guidance notes, research, information and insights here.

Recent Legal Articles

-

We are thrilled to announce that our marketing efforts have achieved yet another milestone! Lexis GRC, one of our flagship solutions, has been prominently featured in the latest edition of Public Sector Leaders publication.

We are thrilled to announce that our marketing efforts have achieved yet another milestone! Lexis GRC, one of our flagship solutions, has been prominently featured in the latest edition of Public Sector Leaders publication. -

While the impending introduction of the Two-Pot Retirement System marks a significant milestone in addressing the reality that only six per cent of South Africans can currently retire comfortably, there are growing concerns about delays in implementation and whether South Africans have sufficient understanding of the system.

While the impending introduction of the Two-Pot Retirement System marks a significant milestone in addressing the reality that only six per cent of South Africans can currently retire comfortably, there are growing concerns about delays in implementation and whether South Africans have sufficient understanding of the system. -

arvis has developed a collaborative SaaS platform that simplifies and automates cumbersome tasks for law firms. It includes matter management automated drafting of letters, court hearing tracking, deadline and client follow-up, and automated invoicing.

arvis has developed a collaborative SaaS platform that simplifies and automates cumbersome tasks for law firms. It includes matter management automated drafting of letters, court hearing tracking, deadline and client follow-up, and automated invoicing. -

The South African judiciary continues to deal with an onerous workload, and diversity, and transformation challenges against a backdrop of continuous evolution in legal practice.

The South African judiciary continues to deal with an onerous workload, and diversity, and transformation challenges against a backdrop of continuous evolution in legal practice. -

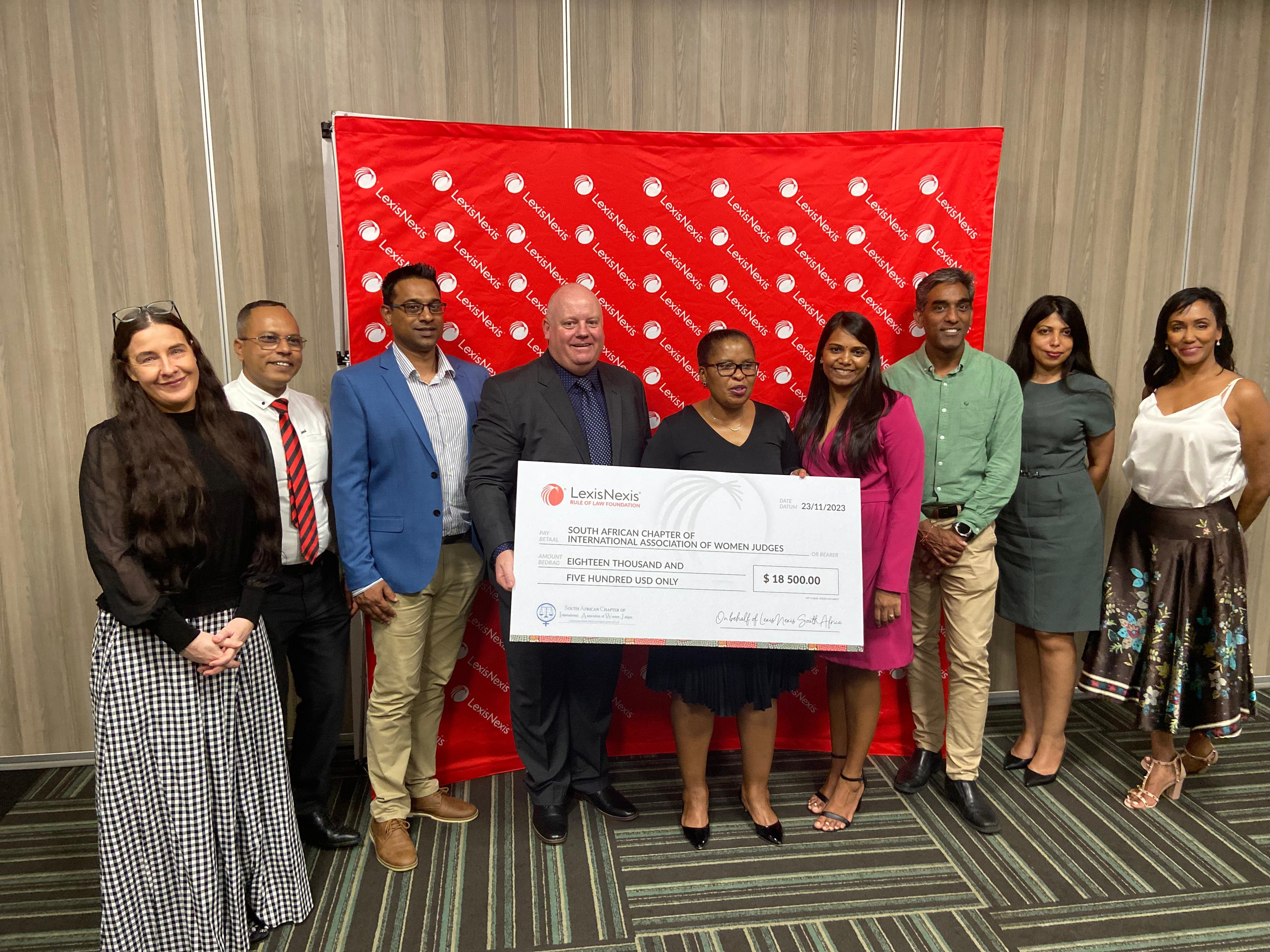

We are delighted to announce that we have awarded a grant of $18,500 (approximately R340,000) to the SAC-IAWJ (South African Chapter of the International Association of Women Judges) Mentorship Program for final-year law students.

We are delighted to announce that we have awarded a grant of $18,500 (approximately R340,000) to the SAC-IAWJ (South African Chapter of the International Association of Women Judges) Mentorship Program for final-year law students.

Lexis Nexis

Lexis Nexis